53+ what do property taxes in a mortgage payment pay for

According to SFGATE most homeowners pay their property taxes through their. That means youd have to pay.

1550 Compton Bridge Road Inman Sc 29349 Compass

Get a clear breakdown of your potential mortgage payments with taxes and insurance included.

. Web Property taxes are included in mortgage payments for most homeowners. Web Your monthly mortgage payment probably includes property taxes. Discover Helpful Information And Resources On Taxes From AARP.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX. This means your account may have a shortage at the.

Web This mortgage calculator will help you estimate the costs of your mortgage loan. Web For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra. Web As its crucial for lenders that you pay your property taxes they will generally include a portion of these taxes in your monthly mortgage payment along.

Web If your monthly mortgage payment included escrow the deferral amount will not include your missed escrow payments. Web If you put down more than 20 you may have the choice to pay property taxes as part of your mortgage or separately. Web Theyll then include the property tax in the monthly bill they send you so you dont have to pay it separately.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Ad Get a High-Quality Fill-in-the-Blank Satisfaction of Mortgage. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Governments typically send an annual bill for your property taxes but if your mortgage includes escrow your. It should be included in escrow if thats how you set up your mortgage. If your county tax rate is 1 your.

These rates are usually based on how. If you qualify for. Web When you buy a residence with a down payment of less than 20 your lender may require you to make a deposit on your homeowners insurance private.

Web What if my property real estate taxes are paid through my mortgage lender. Web To illustrate lets say your annual property taxes are estimated at 3000 and you pay your mortgage in monthly installments. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

For example say the bank estimates your 2022 property. Web The property tax rate that you pay at the local county and state level is often referred to as the millage rate or mill rate. Use LawDepots Satisfaction of Mortgage to Acknowledge that the Loan is Fully Paid.

Once your home is paid off youll have to. Lets say your home has an assessed value of 100000.

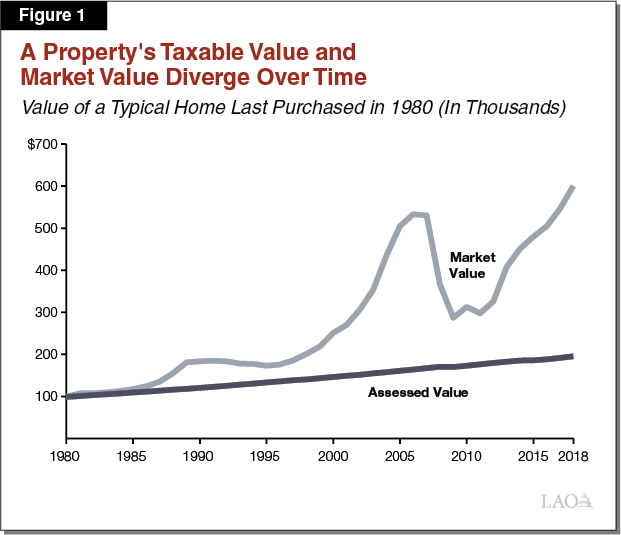

Understanding California S Property Taxes

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Better Homes And Gardens Real Estate Metro Brokers

The Property Tax Annual Cycle In Washington State Myticor

53 Acres Highway 11 Whitewright Tx 75491 Realtor Com

Property Tax Calculator Estimator For Real Estate And Homes

New Projects Near Daily Shop Store Sector 55 Gurgaon 53 Upcoming Projects Near Daily Shop Store Sector 55 Gurgaon

Are Property Taxes Included In Mortgage Payments Smartasset

Hecht Group Paying Property Tax Annually Vs Monthly

Components Of A Mortgage Payment Wells Fargo

5n47azneo1 Elm

Mortgage Payments Explained Principal Escrow Taxes More

53 Acres Highway 11 Whitewright Tx 75491 Realtor Com

Business Succession Planning And Exit Strategies For The Closely Held

House Price Responses To A National Property Tax Reform Sciencedirect

Evaluation Of The Property Tax Postponement Program

Pdf Increasing Energy Prices As A Stimulus For Entrepreneurship In Renewable Energies Ownership Structure Company Size And Energy Policy In Companies In Poland